Your tax refund may be taking a while to arrive in the app. There could be several reasons for this delay. Your refund may be delayed due to a network error. You can resolve the issue by checking your bank details and updating your Cash App. These steps may not be enough to resolve the issue. You may need to contact your employer or the IRS.

Whatever the reason for your refund, you should contact customer service to confirm the status. You should cancel any direct deposits in Cash App as soon as possible. This will prevent you from spending your money waiting. Before you try to get your refund, make sure your bank account has been set up for Cash App direct deposit. You can contact customer service if your refund has not been received after following these steps.

How long does it take for Cash App to receive my tax refund?

Which There How long does it take to receive your tax refund? It takes about two to three weeks for the money to be in your bank account. But it can take many months for your Cash App account to see the money. To receive your refund, the IRS advises you to file your return promptly and arrange for direct bank deposits. This guide will help you navigate the Cash App if you have any questions.

You'll need to enter your routing and account numbers in Cash App when you file your taxes. The refund will automatically be credited to your account once it's processed. The IRS may manually transfer the funds to your account if they don't appear in your account within 7 days. You can contact the IRS if this fails. Before you file your taxes, it's a good idea to make a direct deposit to your bank.

What's happening with the IRS cash refund application?

You may be wondering, “Can I cash my tax refund on Cash App?” It’s not uncommon for taxpayers to wonder, “Can my tax refund be cashed on Cash App?” Many taxpayers have trouble receiving their tax refunds. There are many reasons why some taxpayers may not receive their tax refunds. Here are the top tips for using Cash App to receive your refund. It will be a great decision.

You can apply for a prepaid card or use Cash App to get your tax refund. Your tax refund can be directly deposited using Cash App. Depending on the circumstances, this transfer can take up to 5 business days. In approximately two weeks, you will receive the money through your Cash App. You can also use Cash App to receive your money in approximately two weeks.

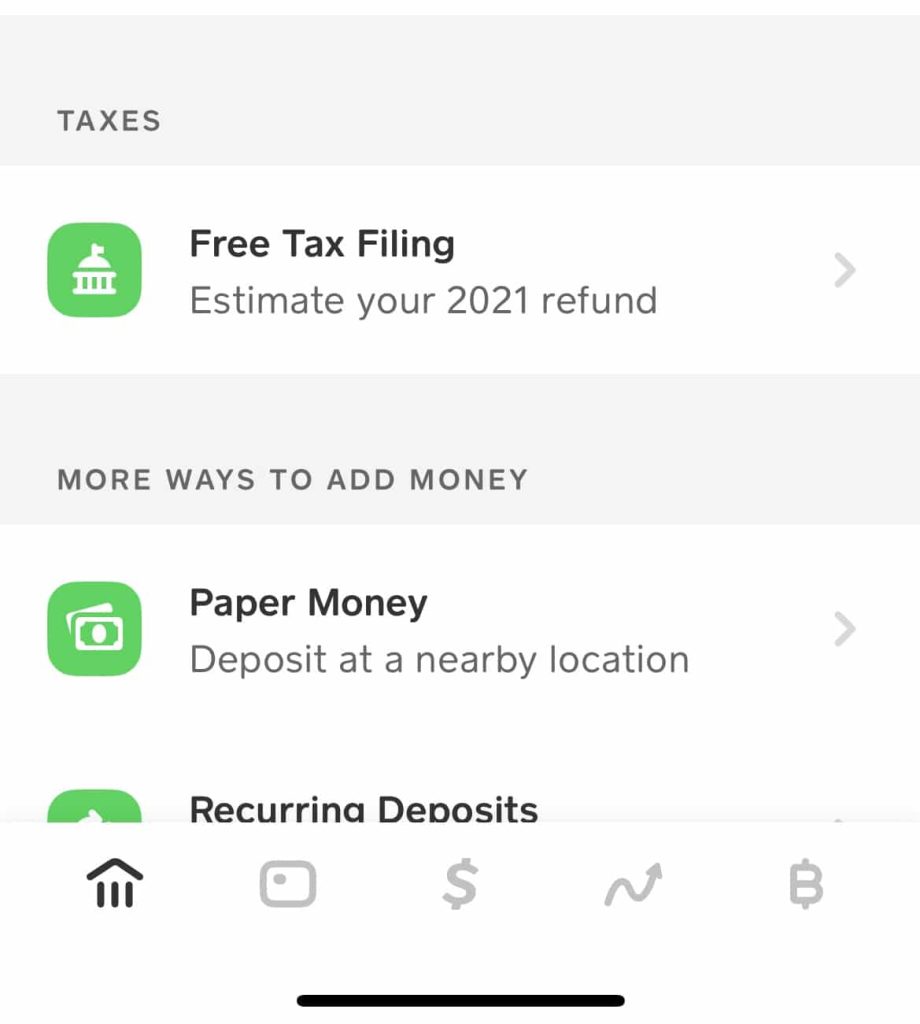

To use Cash App, you'll need an online bank account or a bank account. The app allows you to deposit funds into up to three U.S. banks and onto a prepaid debit card that can be loaded with the app. Your COVID-19 incentive payments can be deposited directly into your Cash App account. Visit the Cash App website to learn more. To receive your tax refund, you can sign up for a Cash App account while you're there.

What time is the 2022 tax refund issued?

When will the IRS refund taxpayers in 2022? Because the IRS has a later deadline for tax returns this year, many people are wondering when they will receive their refunds. This doesn't necessarily mean you won't receive your refund. You may receive your refund as soon as two or three weeks after filing your return. The method you used to file your return will also affect when you receive your refund.

The IRS encourages you to file your tax return electronically to have your refund deposited directly to you. You can have your refund sent directly to your bank account, mobile phone, or prepaid card. Direct deposit refunds can only be received if you provide the routing number and account numbers. The April 18 tax filing deadline is three days earlier than usual, on April 15. The IRS has fraud protections in place that will limit the time it takes to receive your refund.

What happens if your tax refund arrives before the deadline?

You may be wondering if your tax refund can arrive before the Cash App deposit. Within one to five days, your refund will be processed. Your refund will arrive within 1-5 business days if it was deposited into your Cash App account. It may seem like a long wait, but if you do things right, it will be deposited into your checking account within one to five business days.

Sometimes your refund may be delayed due to errors in personal information, network outages, or server errors. You can contact the IRS and your employer for more information if your refund has not been received. Try contacting Cash App customer service if your tax refund has not appeared after trying many methods.

How long does it take for Cash App to make a deposit?

Your refund may not be deposited into your Cash App account until you file your taxes. There are many reasons why your tax refund could be on hold, including an issue with the IRS and/or your debit card. Older apps can also cause your tax refund to be on hold. You may have an issue with Cash App if you've recently updated or installed a new app.

Your tax refund should arrive within a week to several months, depending on when your return was filed and the IRS provides the refund to you. Check the IRS website to confirm if you haven't received your tax refund. The IRS can verify that the refund is in your Cash App account if you haven't received it.

What is the best way to view my pending deposits in Cash App?

Where can I find my pending Cash payments? Apps? On the Activity tab, you can view your pending payments. Click the Pending Payments icon in the bottom right corner. Click Accept to confirm the transaction. You will need to confirm the payment. A pending payment can be accepted manually. You can accept a pending payment by clicking Accept in the confirmation field. You should make sure your request is up to date if this option does not appear.

The Cash app has a status that shows if there are any pending deposits. These payments have not yet been released. You can view the status to find out when the money will be released. There are two possible reasons why a payment is pending: connectivity issues or liquidity issues. You need to know the reason why you have not received the payment. Sometimes the message about pending payments is temporary.

Is my refund delayed until 2022 for this reason?

You may be wondering, “Why is my 2022 Cash App tax refund delayed?” You’re not alone in wondering, “Why is my 2022 Cash App tax refund delayed?” It can be frustrating for many Americans. Your refund could be delayed due to an error with your direct deposit or debit card, a server issue, or an incorrect Social Security number. These steps will help you fix the problem before you panic.

To check if you have a refund, first use the “Where’s My Refund” feature in Cash App. You can access this tool 24 hours after filing your tax return online. Paper returns can take up to four weeks. The “Where’s My Refund?” app lets you enter your Social Security number and the amount of your refund. It will then tell you if your return has been received and approved. The tool can update daily to give you the most recent information. You can also check your status at any time.

The significant backlog in processing your tax returns is another problem. There are more than six million tax returns that the IRS still has to process in this fiscal year's backlog. As of December 31, the IRS has a backlog of more than 6 million returns to process. This is significantly more than was typical at the start of the tax season. The IRS recommends that refunds be received within 21 days of the filing date. Some taxpayers say they have received refunds earlier than expected.

Click here for more details

1.) Cash App Website

4.) Cash App for iOS

My name is Javier Chirinos and I am passionate about technology. Ever since I can remember, I have been interested in computers and video games, and that passion has turned into a job.

I have been publishing about technology and gadgets on the Internet for over 15 years, especially in mundobytes.com

I am also an expert in online marketing and communication and have knowledge in WordPress development.